Do you really Score a home loan or Refinance financing In place of an effective Business?

Josh try your own loans enthusiast and you may publisher. The guy began providing someone understand how to re-finance their homes inside 2008 features become studying and you may knowledge home loan and cash matters since.

Use scene looks very different now than they did simply a short while ago. And more people was curious if we are able to score a good home loan or refinance our house financing instead a traditional nine-to-5.

Could i Get home financing whenever you are Unemployed?

Sure, you should buy a home loan without a job. It is very common to own retired people otherwise people who have resources of earnings you to fall additional salaried otherwise each hour full-go out operate.

Delivering home financing with no employment performs such as for example taking home financing with a job. The most significant differences was documenting how you can easily manage to spend the money for mortgage. For most of us, a position is among the most preferred source of income. However, we all know that is not the only way you can make money. If you’re unable to render loan providers which have proof of a reliable a career record and you will earnings, you’ll want to provide them with research that one can create the month-to-month mortgage payments.

Their bank enjoys you to https://paydayloancolorado.net/monte-vista/ jobs: to confirm to conveniently repay the loan. Your work is to let them have proof of that.

How to get a mortgage With no employment

As you prepare to apply for a mortgage, you need to be willing to confirm your qualification for the lender.

Ready your case

There isn’t any leaking out it, you’ll want to earn new lender’s trust. Show the lending company they should trust you by providing evidence you to you’re economically secure.

Perhaps you’ll end up carrying out a different sort of employment soon. Or perhaps your own profession are regular. Whatever the circumstances was, you’re very likely to end up being approved whenever you show your financial you have enough bucks supplies to add income having 8 days of the year, and you may efficiently budget while making the month-to-month home loan repayments toward kept 4 months.

The main is usually to be ready to tell you a home loan company you have got a plan in place making your repayments.

When you find yourself swinging to own an alternate jobs, you will be able to use your work give letter due to the fact proof a position. Not all loan providers need an offer letter. Speak to your financial to find out if they take on provide emails because proof a job.

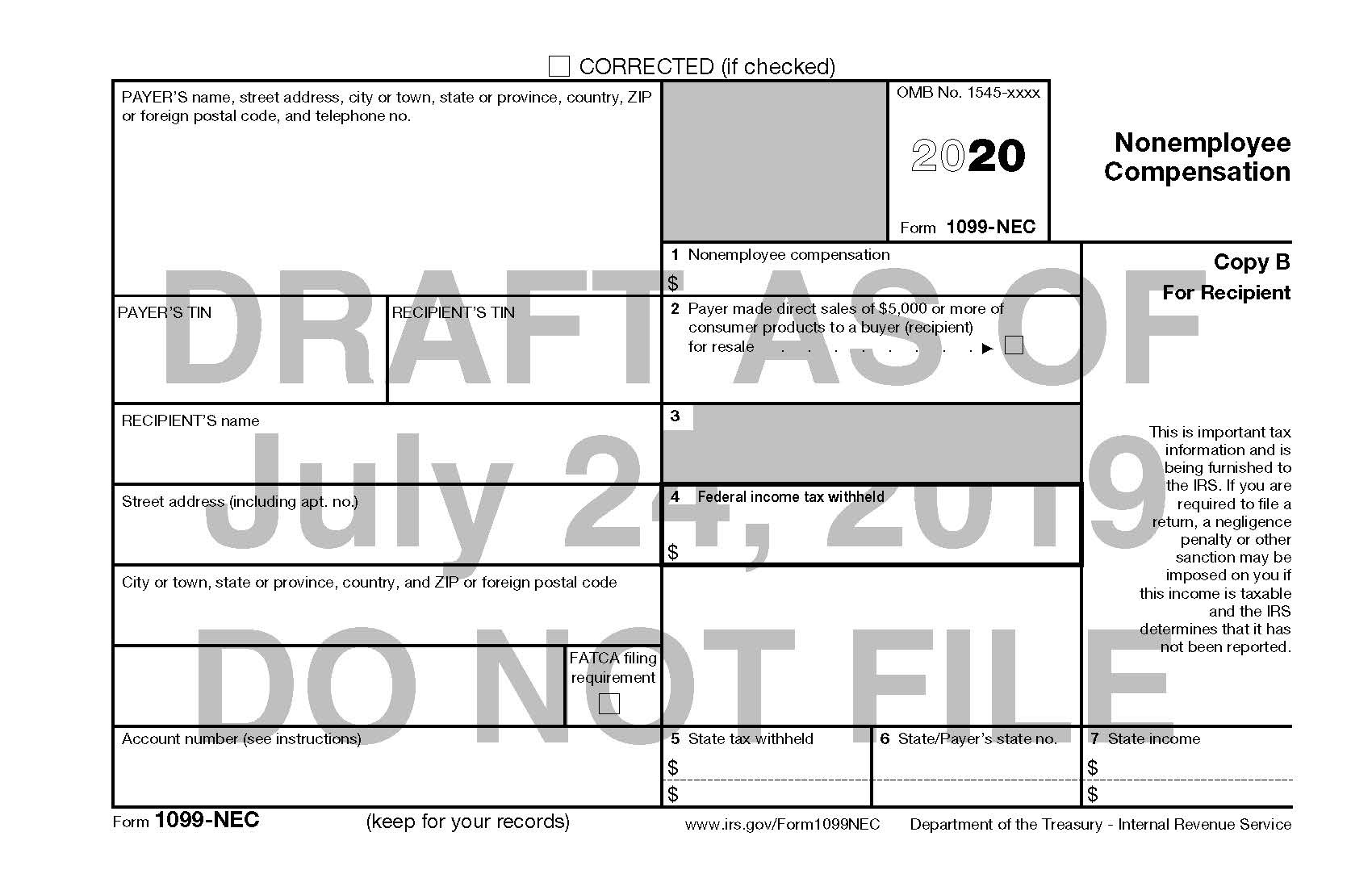

Offer proof of all of the sourced elements of earnings

Earnings is money you get otherwise earn, therefore doesn’t always come from a manager. Loan providers will get accept any of the after the because the legitimate resources of money (even though some supply may count over anyone else):

- Youngster support or alimony costs

- Resource or rental assets earnings

- Old age income

- Dividend money

Communicate with a homes specialist

The newest Agencies off Houses and you may Metropolitan Development (HUD) even offers totally free otherwise lowest-rates property counseling features in order to anyone who demands they. HUD-acknowledged counselors helps you navigate the borrowed funds processes if or not you have a job or not. They may be able help you interest a spending budget, carry out a propose to replace your funds and you will opinion which sort of home loan suits you along with your finances.

Come across a good co-signer

A great co-signer believes to consider the newest financial duty away from paying down a beneficial financing if you can’t. For people who standard towards mortgage, the co-signer is into the hook into the equilibrium. One to amount of chance manage describe why co-signers are usually family relations otherwise loved ones.

Use capital money

People use money out of investment to assist them to score a beneficial home loan. You might cash out opportunities to boost your down-payment or include funding earnings comments along with your application showing your capability to settle the borrowed funds.

-

Posts recentes

- IceBet Gambling enterprise No-deposit Incentive twenty-five Totally free Revolves on Spin and Win casino sign up bonus the Myth by Mascot Playing!

- MyStake casino Room 100 free spins Gambling enterprise: Take one hundred Free Spins

- ING Geld einzahlen: Was auch immer, welches du zur Einzahlung kontakt haben musst

- A local creator that have an ago-right up promote wants to keep and you may adaptively recycle the fresh new historic bank

- PinoCasino: $five hundred Bonus, in addition to 150 Totally winning at video slots free Revolves

Comentários

Arquivos

- novembro 2024

- outubro 2024

- setembro 2024

- agosto 2024

- julho 2024

- junho 2024

- maio 2024

- abril 2024

- março 2024

- fevereiro 2024

- janeiro 2024

- dezembro 2023

- novembro 2023

- outubro 2023

- setembro 2023

- agosto 2023

- julho 2023

- junho 2023

- abril 2023

- fevereiro 2023

- janeiro 2023

- setembro 2022

- julho 2022

- junho 2022

- maio 2022

- abril 2022

- janeiro 2022

- dezembro 2021

- setembro 2021

- agosto 2021

- julho 2021

- junho 2021

- janeiro 2021

- novembro 2020

- outubro 2020

- novembro 2018

Categorias

- ! Без рубрики

- 0,4521460581

- 1

- 1win Brazil

- 1win India

- 1WIN Official In Russia

- 1win Turkiye

- 1win uzbekistan

- 1winRussia

- 1xbet KR

- 1xSlots

- 2

- 212

- 22bet IT

- a cash advance

- a cash advance is

- a good payday loan company

- a payday loan is

- a payday loan near me

- a payday loan?

- a payday loans

- advance ameican payday loans

- advance amercia cash

- advance america advance payday loan

- advance america cash advance payday loans

- advance america cash advance price

- advance america cash advances

- advance america cash loans

- advance america payday loan

- advance america payday loan near me

- advance american cash

- advance bad cash credit loan

- advance bad cash credit loan loan

- advance bad credit loan payday

- advance cash

- advance cash america

- advance cash america loan

- advance cash america payday loans

- advance cash american

- advance cash bank

- advance cash cash loan payday

- advance cash company

- advance cash company loan

- advance cash finance company

- advance cash loan near me

- advance cash loan usa

- advance cash loans

- advance cash log in

- advance cash now

- advance cash payday loan

- advance cash payday loans

- advance cash usa payday loan

- advance loan payday

- advance loan payday loan near me

- advance me now payday loan

- advance me payday loan

- advance of america payday loan

- advance payday cash loan

- advance payday loan near me

- advance payday loans

- advance payday loans bad credit

- advance payday loans near me

- advance payday loans no credit check

- advance the cash

- advance to payday loans

- advance usa payday loans

- advanced america cash advance

- advanced america payday loan

- advanced american cash advance

- advanced american cash advance near

- Agence de messagerie de commande de mariГ©e

- Agencija za mail za mladenku

- america advance cash

- america advance payday loan

- america cash advance

- america cash advance in

- america cash advance near me

- america cash payday loan

- america cash payday loans

- america payday loan

- american advance cash advance

- american advance payday loan

- american advance payday loans

- american bluebird and payday loans

- american cash advance usa

- american credit payday loans

- american loan payday

- american payday cash advance

- american payday loans

- american payday loans advance america

- american payday loans near me

- are cash advance loans

- are payday loans

- are payday loans bad for your credit

- are payday loans useful?

- Artificial intelligence

- Artificial intelligence (AI)

- average price for a mail order bride

- average price for mail order bride

- average price of a mail order bride

- Backup

- bad cash credit loan payday

- bad credi payday loans

- bad crediit payday loans

- bad credit cash advance

- bad credit loan payday

- bad credit loans no payday

- bad credit loans no payday loans

- bad credit loans not a payday loan

- bad credit loans not payday

- bad credit loans not payday advance

- bad credit loans that are not payday loans

- bad credit no credit payday loans

- bad credit payday advance loan

- bad credit payday advance loans

- bad credit payday loan no bank check

- bad credit payday loan no credit check us

- bad credit payday loans direct lenders no credit check

- badcredit payday loans

- bank america cash advance

- bank cash advance

- bank cash advance loans

- bank payday loan

- Bankobet

- banks cash advance

- banks for cash advance

- banks that do payday loans

- banks with cash advance

- banks with payday loans

- Basaribet

- BEST bewertete Versandauftragsbrautseiten

- best cheap essay writing

- best countries to get a mail order bride

- best legit mail order bride websites

- best mail order bride agency

- best mail order bride agency reddit

- best mail order bride company

- best mail order bride countries

- best mail order bride service

- best mail order bride site

- best mail order bride websites

- best place for mail order bride

- best place to get a mail order bride

- best place to get mail order bride

- best places for mail order bride

- best rated mail order bride sites

- best real mail order bride site

- best real mail order bride sites

- best reputation mail order bride

- best site mail order bride

- best website to find a mail order bride

- Beste echte Mail -Bestellung Brautseiten

- Beste Mail -Bestellung Braut aller Zeiten

- Beste Mail -Bestellung Braut Site Reddit

- Beste Reputation Mail -Bestellung Braut

- Bestes Land, um eine Versandbestellbraut zu finden

- Bestes Land, um Versandbestellbraut zu finden

- bet10

- bet10-casino

- Bets

- bhnov

- bhoct

- blog

- Bodybuilding

- Bolts Up Daily

- Bookkeeping

- Brasil

- Braut Weltversandbraut Braute

- BRIDE MAILLEMENT BRIDE Bonne idГ©e?

- bride order mail

- bride world mail order brides

- browse mail order bride

- btbtnov

- btoct

- buen correo orden sitio web de la novia

- buscando matrimonio

- buy a mail order bride

- buy an essay online cheap

- buy essay online for cheap

- buy mail order bride

- buying a mail order bride

- can anyone get a payday loan

- can i get a cash advance

- can i get a cash advance?

- can i get cash advance

- can i have payday loans and get cash advance

- can payday loans go on your credit

- can you get a payday loan from your bank

- can you get a payday loan with bad credit

- can you get a payday loan with no credit

- cash advance america advance

- cash advance america loan

- cash advance america payday loan

- cash advance america usa

- cash advance america usa loan

- cash advance american

- cash advance american payday loan

- cash advance and payday loan

- cash advance and payday loans

- cash advance at banks

- cash advance banking

- cash advance cash

- cash advance cash advance

- cash advance cash america

- cash advance company

- cash advance credit

- cash advance d?finition

- cash advance def

- cash advance for bad credit and no credit check

- cash advance for bad credit no

- cash advance for horrible credit

- cash advance how to

- cash advance how to get it?

- cash advance in america

- cash advance is

- cash advance is cash usa

- cash advance is what

- cash advance lenders no check systems no credit check

- cash advance loan bad credit

- cash advance loan no credit check

- cash advance loan payday

- cash advance loan payday advance

- cash advance loans

- cash advance loans near me

- cash advance loans no credit check direct lender

- cash advance loans no credit check near me

- cash advance loans with bad credit

- cash advance near me bad credit

- cash advance near me now

- cash advance nearby

- cash advance nearest me

- cash advance nearme

- cash advance neat me

- cash advance no

- cash advance no interest

- cash advance now

- cash advance now loan

- cash advance now loans

- cash advance now no credit check

- cash advance of

- cash advance of america

- cash advance on bank america

- cash advance on credit

- cash advance tomorrow

- cash advance usa loan company

- cash advance usa price

- cash advance use

- cash advance what is needed

- cash advance with no credit check

- cash advance?

- cash advances and payday loans

- cash advances payday loan

- cash advances payday loans

- cash advances payday loans near me

- cash america advance loans

- cash america advance payday loans

- cash america cash advance

- cash america payday advance

- cash america payday loan

- cash america payday loan near me

- cash and go payday loans

- cash cash advance

- cash cash payday loan

- cash company advance

- cash credit payday loans

- cash go payday loan

- cash in advance loans

- cash in advance near me

- cash loan advance

- cash loan advance bad credit

- cash loan advance near me

- cash loan payday advance

- cash loan payday loan

- cash loans advance america

- cash loans and payday advances

- cash loans payday

- cash loans payday loans

- cash of advance

- cash pay advance

- cash payday advance

- cash payday advance loans

- cash payday loan now

- cash to advance

- cash to go payday loans

- cash to payday loan

- cash usa payday loans

- casino

- casino en ligne fr

- casino onlina ca

- casino online ar

- casinò online it

- casinos

- Catalogue de la mariГ©e par correspondance

- che cos'ГЁ una sposa per corrispondenza?

- cheap custom essay

- cheap custom essay writings service

- cheap essay papers

- cheap essay writing 24 hr

- cheap essay writing sites

- cheap reflective essay proofreading website online

- chnov

- choct

- Cloud

- come sposare una sposa per corrispondenza

- Commandage mariГ©e Craigslist

- Commande par courrier de la mariГ©e

- Commandez de la courrier mariГ©e rГ©elles histoires

- commanditГ©

- Comment commander la commande par courrier mariГ©e

- company loan payday

- compaГ±Гas de novias legГtimas de pedidos por correo

- correo en orden novia

- correo legГtimo ordenar sitios de novias reddit

- correo orden informaciГіn de la novia

- correo orden novia craigslist

- correo orden novia legГtima?

- correo orden novia sitio real

- Courrier pour commander la mariГ©e

- CoГ»t moyen d'une mariГ©e par correspondance

- CoГ»t moyen de la mariГ©e par correspondance

- credit payday loan

- credit payday loans

- Cryptocurrency exchange

- cГіmo comprar una novia por correo

- Datacenters

- deberГa salir con una novia por correo

- definiciГіn de servicios de novias por correo

- diez mejores sitios web de novias por correo

- do banks do payday loans

- donde compro una orden de correo novia

- Durchschnittspreis fГјr eine Versandbestellbraut

- DГ©finition de la mariГ©e par correspondance

- Echte Versandbestellbraut -Sites

- Echte Versandbestellbrautwebsites

- ekte postordre brud nettsted

- encontrar una novia

- encontrar una novia por correo

- Esports

- Faits de mariГ©e par correspondance

- fast custom essay writing service

- find a bride

- find mail order bride

- find me a mail order bride

- finding a mail order bride

- FinTech

- foreign brides

- Forex Trading

- Free

- get a cash advance with bad credit

- get a payday loan

- get a payday loan advance

- get a payday loan bad credit

- get a payday loan near me

- get a payday loan no credit check

- get a payday loan with no credit

- get a payday loans with other payday loans

- get cash advance at bank

- get cash advance loan

- get cash now on a payday loan

- get cash now payday loan

- get cash payday loan

- get cash payday loan loan

- get full credit as cash advance

- get loan payday

- get oui of payday loans

- get payday cash advance

- get payday loan

- get payday loan no credit check

- get payday loan now

- getting a cash advance

- getting a cash advance at a bank

- getting a loan from cash advance america

- getting a payday loan

- getting a payday loan with bad credit

- getting cash advance

- getting payday loans

- GGBet kasyno

- god postordre brud nettsted

- good mail order bride sites

- good payday loans no credit check

- hello

- help me with essay writing cheap

- help write my essay for me

- historia correo orden novia

- history mail order bride

- hottest mail order bride

- how can i get a cash advance

- how can i get a payday loan with bad credit

- how can i get a payday loan?

- how do a payday loan work

- how do cash advance work

- how do i get a cash advance from a bank

- how do i get a payday loan

- how do payday loans

- how do payday loans works

- how do you do cash advance

- how do you get a loans from a cash advance

- how do you renew a payday loan

- how does a cash advance work

- how does a cash advance works

- how does a mail order bride work

- how does a payday loan work

- how does cash in advance work

- how does cash in advance works

- how does getting payday loan work

- how does payday advance loans work

- how does payday cash advance work

- how does payday loan works

- how does payday loans work

- how does the cash advance work

- how i can get advance cash

- how much can i get from a payday loan

- how much can i get in a payday loan

- how much can i get on a payday loan

- how much can i get payday loan

- how much can i get with a payday loan

- how much can you get from a cash advance

- how much can you get on a cash advance

- how much can you get on a payday loan

- how much cash advance can i get

- how much cash can you get with a payday loan

- how much do you get for payday loans

- how much interest are payday loans

- how much interest cash advance

- how much interest do you pay on a cash advance

- how much interest do you pay on a payday loan

- how much interest is on a payday loan

- how much interest on a cash advance

- how much interest on cash advance

- how much is a cash advance from advance america

- how much is a payday loan

- how much is interest on a cash advance

- how much is interest on cash advance

- how much is my cash advance interest

- how much of a cash advance can i get

- how much payday loan can i get

- how mush interest on a payday loan

- how oftern can you get payday loan

- how payday loans work in usa

- how to buy a mail order bride

- how to cash advance at other bank

- how to cash advance on credit

- how to do a cash advance

- how to do mail order bride

- how to get a cash advance from payday

- how to get a cash advance from your bank

- how to get a cash advance with bad credit

- how to get a payday loan near me

- how to get a payday loan with no credit check

- how to get cash advance from bank

- how to get cash from credit wtihout cash advance

- how to get get a payday loan

- how to get payday loan

- how to get payday loan with bad credit

- how to get payday loans

- how to mail order bride

- how to marry a mail order bride

- how to order a russian mail order bride

- how to payday loans

- how to prepare a mail order bride

- how to prepare a mail order bride reddit

- how to use cash advance

- how to use payday loans

- hyvä postimyynti morsiamen verkkosivusto

- i need a cash advance loan

- i need a cash advance now

- i need a payday loan bad credit

- i need a payday loan but i have bad credit

- i need a payday loan now with bad credit

- i need a payday loan with bad credit

- i need a payday loan?

- i need cash advance

- i want a mail order bride

- if a payday loan

- in cerca di una sposa per corrispondenza

- Informations sur les mariГ©es par correspondance

- Instances

- instant cash payday loans no credit check

- instant payday loan direct lender no credit check

- instant payday loan no credit check direct lender

- instant payday loans company

- is a cash advance bad

- is a cash advance bad for your credit

- is cash advance bad for your credit

- is mail order bride a real thing

- is mail order bride real

- is mail order bride safe

- is mail order bride worth it

- is payday loan

- IT Vacancies

- IT Вакансії

- IT Образование

- Kakva narudЕѕba poЕЎte

- Kann ich eine Versandungsbraut bekommen, wenn ich bereits verheiratet bin?

- Kasyno Online PL

- Kauf einer Mail -Bestellung Braut

- Kaufen Sie eine Mail -Bestellung Braut

- king johnnie

- kuinka päivämäärä postimyynti morsiamen

- kymmenen parasta postimyynti morsiamen sivustoa

- Können Sie eine Braut bestellen?

- La courrier Г©lectronique en vaut la peine?

- La mariГ©e par correspondance est-elle rГ©elle

- la migliore sposa per corrispondenza di sempre

- la novia del pedido por correo

- laillinen postimyynti morsiamen sivusto

- lailliset postimyynti morsiamen palvelut

- lailliset postimyyntiyritykset

- Legale Versandhandel Seiten für Bräute

- leggit mail order bride sites

- Legit Mail narudЕѕbe mladenke

- legit mail order bride

- legit mail order bride service

- legit mail order bride site

- legit mail order bride sites reddit

- legit no credit check payday loans

- legit postimyynti morsiamen sivustot

- legit postimyynti morsiamen sivustot reddit

- legitimale Versandbestellung russische Braut

- legitimate mail order bride

- legitimate mail order bride websites

- legitime Mail -Bestellung Braut Site

- legitime Mail -Bestellung Brautdienste

- Legitime Mail bestellen Brautwebsite

- legitimne narudЕѕbe za mladenke

- legitimne web stranice za mladenke

- legitimte mail order bride service

- Les sites de mariГ©e par correspondance lГ©gitimes

- lesbian mail order bride

- lesbian mail order bride reddit

- list of best mail order bride sites

- Liste der besten Mail -Bestell -Braut -Sites

- Liste des meilleurs sites de mariГ©es par correspondance

- LoadBalancing

- loan cash advance

- loan for bad credit not a payday loan

- loan for bad credit not payday loan

- loan for cash advance

- loan for payday

- loan me payday loan

- loan payday bad credit

- loan payday loan

- loan payday loans

- loan payday near me

- loan to payday

- loans for bad credit no payday loans

- loans no payday loans

- loans not payday

- loans not payday loans

- loans now but not payday

- loans payday bad credit

- loans payday near me

- loans unlimited cash advance

- looking for a mail order bride

- looking for payday loan

- looking for payday loans

- low interest payday loans no credit check

- Mail -Bestellung Braut definieren

- Mail -Bestellung Braut legitim

- Mail -Bestellung Brautagentur mit dem besten Ruf

- Mail -Bestellung Brautbewertung

- Mail -Bestellung Brautdienste Definition

- Mail -Bestellung Brautkatalog

- Mail -Bestellung Brautkupon

- Mail bestellen Braut Arbeit?

- Mail bestellen Braut echte Geschichten

- Mail bestellen Braut FAQ

- Mail bestellen Braut Websites Reddit

- Mail bestellen Braut Wikipedia

- Mail bestellen Brautgeschichten

- Mail bestellen Brautinformationen

- Mail bestellen Brautstandorte legitim

- Mail bestellen Brautwebes Reddit

- Mail bestellen Frauen

- mail bride order

- Mail dans l'ordre de la mariГ©e

- Mail dans l'ordre du coГ»t de la mariГ©e

- Mail in der Bestellung Brautdefinition

- mail in order bride

- mail in order bride cost

- Mail narudЕѕba mladenka na prodaju

- Mail narudЕѕba mladenka vrijedi?

- Mail narudЕѕbe mladenke agencije

- mail order bride agences

- mail order bride agency reviews

- mail order bride agency with the best reputation

- mail order bride catalogs

- mail order bride catalogue

- mail order bride countries

- mail order bride coupon

- mail order bride dating

- mail order bride dating site

- mail order bride definition

- mail order bride for real?

- mail order bride industry

- mail order bride info

- mail order bride legit?

- mail order bride real

- mail order bride real site

- mail order bride review

- mail order bride reviews

- mail order bride services

- mail order bride sites reddit

- mail order bride stories

- mail order bride stories reddit

- mail order bride story

- mail order bride website reviews

- mail order bride websites

- mail order bride websites reddit

- mail order bride websites reviews

- mail order bride wiki

- mail order bride work?

- mail order bride worth it

- mail order bride worth it?

- mail order wives

- mail-order bride

- mariГ©e par correspondance

- mariГ©e par correspondance en ligne

- mariГ©e par correspondance la plus chaude

- mariГ©e par correspondance lesbienne

- mariГ©e par correspondance lГ©gitime

- mariГ©e par correspondance rГ©elle

- MarryMeUSA

- Masalbet

- Meilleur pays de mariГ©e par correspondance

- Meilleure agence de mariГ©e par correspondance

- mejor correo orden novia agencia reddit

- mejor correo orden sitios web de novias reddit

- mejor paГs para encontrar la novia del pedido por correo

- mejor paГs para encontrar una novia por correo

- mejores lugares para la novia por correo

- mejores sitios para novias por correo

- mikä on postimyynti morsian

- mistä ostan postimyynti morsiamen

- miten postimyynti morsian toimii

- MostBet

- Mostbet Russia

- mostbet tr

- my cash advance

- my cash advance payday loans

- my cash now payday loan

- Najbolja narudЕѕba Mail ikad

- Najbolja narudЕѕba za mladenku

- Najbolje mjesto za dobivanje mladenke za narudЕѕbu poЕЎte

- Najbolje narudЕѕbe mladenke

- Najbolje narudЕѕbe za mladenke

- Najbolje ocijenjene web stranice za narudЕѕbu poЕЎte

- navegar por correo orden novia

- near me payday loan

- nearby cash advance

- nearby payday loan

- nearest cash advance to me

- nearest payday loans

- need a cash advance

- need a cash advance now

- need a payday advance loan now bad credit

- need a payday loan

- need a payday loan bad credit

- need a payday loan no credit check

- need a payday loan now bad credit

- need a payday loan or cash advance

- need a payday loan with no credit check

- need a payday loans

- need a payday loans or cash advance no credit check

- need cash advance

- need cash no payday loans

- need cash now payday loan

- need payday loan

- need payday loan now

- need to get a payday loan

- New

- new cash advance

- new year payday loan

- new year payday loans

- no credit check advance payday loans

- no credit check bad credit payday loans

- no credit check cash advance

- no credit check cash advance loans

- no credit check cash advance near me

- no credit check cash advance places near me

- no credit check direct lenders payday loans

- no credit check instant cash advance

- no credit check instant payday loans

- no credit check loan cash advance

- no credit check loan payday

- no credit check no bank account payday loans

- no credit check payday loan direct lenders

- no credit check payday loan direct lenders only

- no credit check payday loan lender

- no credit check payday loan near me

- no credit check payday loans on line

- no credit check payday low intrest loan

- novia de pedidos por correo

- novia mГЎs caliente por correo

- Novidades

- Online Casino

- online casino au

- orden de correo internacional novia

- orden de correo legГtimo novia

- oГ№ acheter une mariГ©e par correspondance

- paras maa postimyynti morsiamen reddit

- paras postimyynti morsiamen sivusto reddit

- paras postimyynti morsiamen verkkosivusto

- parhaat maat saada postimyynti morsiamen

- parhaat postimyynti morsiamenyritykset

- parhaiten arvioidut postimyynti morsiamen sivustot

- pay cash in advance

- pay for someone to do my essay

- pay for someone to write an essay

- pay for write essay

- pay for writing essay

- payday advance cash

- payday advance loan

- payday advance loan no credit check

- payday advance loans

- payday advance loans bad

- payday advance loans bad credit

- payday advance loans near me

- payday advance loans no credit check

- payday advance loans with no credit check

- payday advanced loan

- payday advances loan

- payday advances loans

- payday advances or payday loans

- payday america loan

- payday america loans

- payday american loans

- payday and cash advance loans

- payday bad credit loan

- payday bank loans

- payday cash advance bad credit

- payday cash advance for bad credit

- payday cash advance in

- payday cash advance loan

- payday cash advance loan bad credit

- payday cash advance loans

- payday cash advance loans near me

- payday cash advance loans no credit check

- payday cash advance no credit check

- payday cash loan advance

- payday cash loans bad credit

- payday cash loans with bad credit

- payday instant loans no credit check

- payday istallment loans

- payday loan advance america

- payday loan advance no credit check

- payday loan agency no credit check

- payday loan american

- payday loan and

- payday loan at a bank

- payday loan bad credit loan

- payday loan bad credit near me

- payday loan bad credit no credit check

- payday loan bad credit no credit check near me

- payday loan bank

- payday loan cash america

- payday loan cash in minutess

- payday loan companies with no credit check

- payday loan company

- payday loan company definition

- payday loan company near me

- payday loan company no credit check

- payday loan creator

- payday loan credit

- payday loan direct lender only no credit check

- payday loan direct lenders no credit check

- payday loan direct lenders only no credit check

- payday loan finder

- payday loan for

- payday loan for bad credit near me

- payday loan for bad credit no credit check

- payday loan for no credit

- payday loan from

- payday loan in

- payday loan in usa

- payday loan instant funding no credit check

- payday loan instant no credit check

- payday loan interest rates?

- payday loan leanders

- payday loan lender no credit check

- payday loan lenders no credit check

- payday loan lenders with no credit check

- payday loan near

- payday loan near me bad credit

- payday loan near me now

- payday loan nearby

- payday loan need now

- payday loan needed

- payday loan new

- payday loan no

- payday loan no bank

- payday loan no broker no credit check

- payday loan no credit

- payday loan no credit check direct lenders

- payday loan no credit check instant

- payday loan no credit check instant payout

- payday loan no credit check no bank account

- payday loan no credit check no checking account

- payday loan no credit check on line loans

- payday loan no creditcheck

- payday loan no interest

- payday loan now bad credit

- payday loan now no credit check

- payday loan now with bad credit

- payday loan of america

- payday loan on

- payday loan or cash advance

- payday loan payday loans

- payday loan usa

- payday loan what is a

- payday loan what is payday loan

- payday loan with

- payday loan with bad credit

- payday loan with bad credit and no credit check

- payday loan with bad credit near me

- payday loan with no credit

- payday loan works

- payday loans advance

- payday loans advance america

- payday loans advances

- payday loans america

- payday loans and how they work

- payday loans and interest

- payday loans are bad

- payday loans bad cradit?

- payday loans bad credit

- payday loans bad credit advance america

- payday loans bad credit loans and cash advance loans

- payday loans bad credit near me

- payday loans bad credit no credit check

- payday loans bad credit no credit check direct lender

- payday loans bad creditt

- payday loans bad for credit

- payday loans cash advance america

- payday loans cash advance for bad credit

- payday loans cash advance no credit check

- payday loans cash advances

- payday loans cash loans

- payday loans com

- payday loans credit

- payday loans def

- payday loans direct lenders with no credit check

- payday loans direct no credit check

- payday loans do they work

- payday loans facts

- payday loans for

- payday loans for anyone

- payday loans for awful credit

- payday loans for bad credit direct lender no credit check

- payday loans for bad credit loans

- payday loans for bad credit near me

- payday loans for bad credit no credit check

- payday loans for extremely bad credit

- payday loans for horrible credit

- payday loans for no credit

- payday loans for nocredit

- payday loans forbad credit

- payday loans info

- payday loans instant no credit check

- payday loans lenders not brokers no credit check

- payday loans low interest no credit check

- payday loans near

- payday loans near me bad credit

- payday loans near me for bad credit

- payday loans near me no bank

- payday loans near me with no credit check

- payday loans nearby

- payday loans nearme

- payday loans need credit

- payday loans new

- payday loans no bad credit

- payday loans no bank

- payday loans no brokers no credit check

- payday loans no credit check

- payday loans no credit check bad credit

- payday loans no credit check debit card

- payday loans no credit check direct deposit

- payday loans no credit check direct lenders

- payday loans no credit check instant payout

- payday loans no credit check lenders

- payday loans no credit check low interest

- payday loans no credit check no checking account

- payday loans no credit check no lenders

- payday loans no credit check or bank account

- payday loans no credit check or verification

- payday loans no credit check usa

- payday loans no credit near me

- payday loans now bad credit

- payday loans on

- payday loans or bad credit loans

- payday loans or cash advances

- payday loans that work

- payday loans usa

- payday loans use passport

- payday loans very bad credit

- payday loans what are they

- payday loans what do you need

- payday loans what is

- payday loans with

- payday loans with no bank account or credit check

- payday loans with no credit

- payday loans with no credit check and no bank account

- payday loans with no credit check direct lender

- payday loans with no credit check or bank account

- payday loans with no credit check or checking account

- payday no credit check loan

- payday now cash advance

- payday now loan

- payday usa loans

- pbnov

- pboct

- per corrispondenza la sposa ne vale la pena

- pinco

- Post in der Bestellung Braut

- Post in der Bestellung Brautkosten

- posti järjestyksessä morsiamen kustannukset

- posti morsiamen määritelmän mukaan

- postimyynti morsiamen artikkeleita

- postimyynti morsiamen sivustot reddit

- postimyynti morsiamen tarinoita reddit

- postimyynti morsian

- Prava narudЕѕba za mladenku

- Prava web stranica za mladenku

- Prix ​​moyens des mariées par correspondance

- Provisioning

- punov

- puoct

- Qu'est-ce que la mariГ©e par correspondance?

- que es una novia por correo

- quicken payday loans

- quicker cash payday loans

- quickest cash advance com

- quickest payday loan com

- quickpay payday loan

- quickpay payday loans

- real mail order bride

- real mail order bride service

- real mail order bride sites

- real mail order bride websites

- real no credit check payday loans

- real payday loan lenders no credit check

- real payday loans no credit check

- Reels

- Releases

- Resources

- Reviews

- revisiГіn de la novia por correo

- safe payday loans no credit check

- secure payday loans no credit check

- Sem categoria

- seo

- seo-links

- Service de mariГ©e par correspondance rГ©el

- Services de mariГ©e par correspondance lГ©gitime

- servicio de novia de pedidos por correo mejor calificado

- servizi per la sposa di alta corrispondenza

- servizio sposa per corrispondenza

- Site de la mariГ©e par correspondance des dix premiers

- site Web de la mariГ©e par correspondance

- sites de mariГ©e par correspondance reddit

- sites lГ©gitimes de mariГ©e par correspondance

- sitio de citas de novias por correo

- sitio de la novia de orden de correo superior

- sitio de la novia de pedidos por correo real

- sitio de novia de pedido por correo legГtimo

- sitios de citas de novias por correo

- sitios de novias de orden de correo superior

- sitios legГtimos de novias por correo

- sitios web de novias por correo

- sito della sposa per corrispondenza superiore

- Slots

- small payday loans company in usa

- So erstellen Sie eine Versandbestellbraut

- So kaufen Sie eine Mail -Bestellung Braut

- Sober Living

- Software development

- Strategies

- Suchen Sie eine Versandbestellbraut

- Tantra

- Techniques

- Top -Mail -Bestellung Braut Site

- Top -Mail -Bestellung Braut sitzt

- Top -Mail -Bestellung Brautdienste

- Top 10 de la mariГ©e par correspondance

- Top 10 des sites de mariГ©es par correspondance

- Top 10 Versandbestellbraut -Sites

- Top 5 web mjesta za narudЕѕbu poЕЎte

- Top Mail Command Bride Site

- top mail order bride

- top mail order bride countries

- top mail order bride services

- top mail order bride site

- top mail order bride sites.

- top mail order bride sits

- top mail order bride websites

- top rated mail order bride service

- top rated mail order bride sites

- top ten mail order bride site

- top ten mail order bride webites

- topp ordre brud

- tosi tarina postimyynti morsiamen

- true mail order bride

- true mail order bride stories

- Uncategorized

- une mariГ©e par correspondance

- us cash advance loan company

- usa cash advance loan

- usa cash advance loans

- usa cash payday loans

- usa payday loan

- usa payday loan near me

- usa payday loans

- vera sposa per corrispondenza

- verdadera orden de correo novia

- vero servizio di sposa per corrispondenza

- Versandbestellbraut definitiom

- Versandbestellung Frau

- vieraat morsiamet

- Was fГјr eine Mail -Bestellung Braut

- Was ist die beste Versandungsbestellung Brautland

- Was ist eine Mail -Bestellung Braut

- Was sind Postanweisungen Brautdienste

- Wellness

- wha is cash advance

- whar is a payday loan?

- what a mail order bride

- what a payday loan

- what are a payday loan

- what are cash advance loans

- what are payday loans used for

- what are payday loans?

- what are payday loans\

- what are the best mail order bride sites

- what bank can i go to for cash advance

- what banks do cash advance

- what banks do payday loans?

- what can you get payday loans for

- what cash in advance

- what do i need for a cash advance

- what do i need for a cash advance loan

- what do i need for payday loans

- what do i need to get a cash advance

- what do i need to get a payday loan

- what do i need to get payday loan

- what do you need for a cash advance

- what do you need for a payday loan

- what do you need for a payday loan?

- what do you need for cash advance

- what do you need for payday loan

- what do you need for payday loans

- what do you need to do a payday loan

- what do you need to get a cash advance from

- what do you pay on a payday loan

- what i need to get a payday loan

- what is a bank cash advance

- what is a bank lobby cash advance

- what is a cash advance

- what is a cash advance apex

- what is a cash advance company

- what is a cash advance from a bank

- what is a cash advance loan

- what is a cash advance loan?

- what is a cash advance?

- what is a good payday loan company

- what is a mail order bride

- what is a mail order bride?

- what is a payday loan company

- what is a payday loan?

- what is advance cash

- what is advance cash loans

- what is an payday loan

- what is an payday loans

- what is as mail order bride

- what is bank cash advance

- what is cash advance

- what is cash advance loan

- what is interest cash advance

- what is mail order bride

- what is mail order bride services

- what is mail-order bride

- what is needed for a payday loan

- what is needed to get a cash advance

- what is payday cash loan

- what is payday loan company

- what is payday loan usa

- what is the best cheap essay writing service

- what is the mail order bride?

- what you need for a payday loan

- what's meen cash advance

- what's needed for cash advance

- what's needed to get a payday loan

- what's payday loan

- whats a cash advance?

- whats a mail order bride

- whats a payday loan

- whats a payday loans

- whats cash advance

- when and where you get payday loan

- where can i get a bad credit payday loan

- where can i get a cash advance

- where can i get a cash advance with bad credit

- where can i get a mail order bride

- where can i get a payday loan

- where can i get a payday loan near me?

- where can i get cash advance

- where can i get my payday loan

- where can i get payday loan

- where can i get payday loans near me

- where can i go to get a cash advance

- where can i go to get a payday loan

- where can i use cash advance

- where can you do a cash advance

- where can you get payday loans

- where do i buy a mail order bride

- where do i find a mail order bride

- where do i get a payday loan

- where get cash advance

- where get payday loans

- where is the nearest payday loan

- where to do cash advance

- where to get a payday loan with bad credit

- where to get payday loan

- where to get payday loan near me

- where to get payday loans near me

- which bank do cash advance

- which payday loan

- which payday loans

- who do cash advance

- who do you use for payday loans

- who does payday loans

- who needs payday loans

- who uses payday loans and why

- why advance cash

- why get a cash advance

- why get a payday loan

- why get payday loans

- Wie funktionieren Versandbestellbraut -Sites?

- Wie funktioniert die Mail -Bestellung Braut?

- Wie funktioniert die Versandbraut, die Braut funktioniert?

- Wie funktioniert eine Versandbestellung Braut

- wikipedia correo orden novia

- wikipedia mail order bride

- Wo kann ich eine Versandungsbraut bekommen?

- Wo kann man eine Versandbestellbraut finden

- Wo kann man eine Versandbestellbraut kaufen

- write essay for me online

- write my class essay

- write my essay for me website

- write my essay no plagiarism

- ВїCuГЎl es el mejor paГs de novias por correo

- ВїCГіmo funcionan los sitios de novias por correo

- ВїDГіnde puedo obtener una novia por correo

- ВїQuГ© es una novia de pedidos por correo?

- Г la recherche d'un mariage

- Комета Казино

- Финтех

- Форекс Брокеры

- Форекс Обучение

- บาคาร่า เว็บตร

Meta